Gold Vs Bitcoin & Will the US Election results cause the price of gold to soar or plunge?

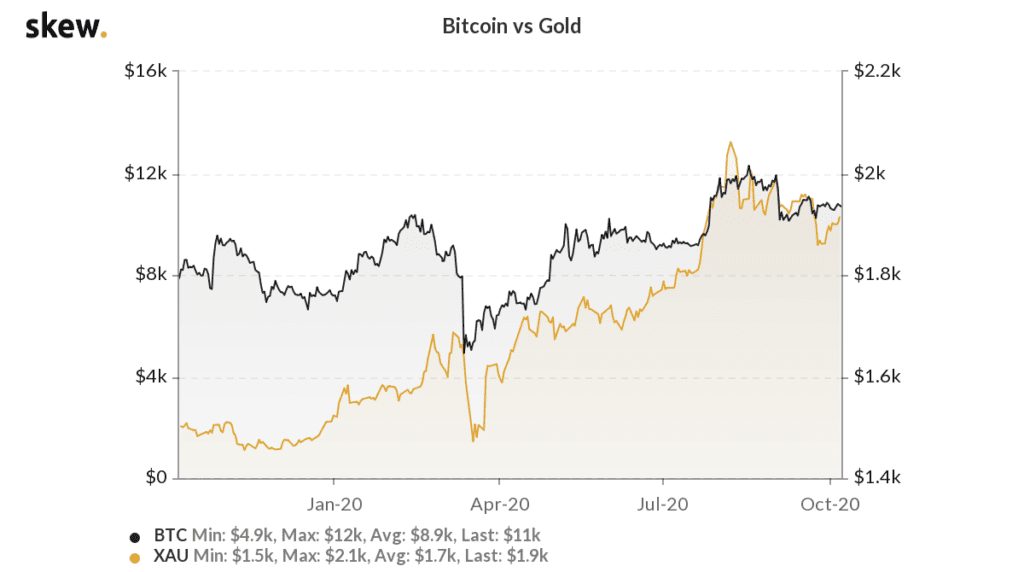

[Check the chart of Gold vs Bitcoin below. Jan]

The US presidential race is on and with less than a month until the 2020 election, political tensions are running high. This is causing volatility in the financial markets as the future price of currency, commodities, and stocks is uncertain.

A Weakening Dollar

The effect of the election on the price of gold is a topic of passionate debate. It’s generally understood that the value of the US dollar correlates with the price of gold. A high dollar value means a lower price for gold while a weaker dollar means a higher price for gold.

Some believe a President Trump win will increase the value of the dollar and a Biden win will decrease it, but no one knows for sure and equally the opposite could come true.

So, what will happen to the price of gold if Joe Biden wins the 2020 US election? This is a question precious metal investors should be asking themselves, but there are many factors to consider before a conclusion can be reached.

Image taken from NBC News website

Image taken from NBC News website

Three scenarios

When Donald Trump won the 2016 election, the price of gold fell and stocks rallied, so it stands to reason that if he loses in 2020, there will be a stock market crash propelling the price of gold. But things are never this simple. The stock market has already seen an unprecedented rally this year, mainly spurred on by mass government stimulus. So, if more stimulus is forthcoming, then this rally may well continue.

First and foremost, there are three scenarios to consider:

- Biden wins a full sweep at the election resulting in the Democrats controlling the house and the senate.

- Biden wins the election but not the senate.

- Biden loses and Trump wins.

FULL DEMOCRATIC CONTROL

In the first scenario, the Democrats win outright, and Biden controls the house and senate. Joe Biden, (the 77-year-old Candidate for the President of the United States, 2020), has committed to making sweeping changes with regards to regulation. He is a big fan of a greener economy, so he is not a friend to the mining industry.

Biden’s regulatory changes are expected to include a $1.7 trillion climate policy and a $1.3 trillion infrastructure improvement plan. These would be great for improving the future of the country, but would drastically increase the national debt at a time when it’s already perilously high. He is also expected to bring in corporate and capital gains tax hikes and industry regulations. This would put further strain on the value of the dollar, which would be bad for US stocks, but positive for the price of gold.

DEMOCRATIC PRESIDENT, REPUBLICAN SENATE

In the second scenario, Biden wins the election, but the Republicans still control the senate. Here, Trump’s tax regime will likely remain, and Biden’s hands will be tied. This may keep the markets steadier, as the changes will be less impactful, and uncertainty reduced. Biden’s reign is expected to be calmer, without the unpredictable and random acts of control Trump is famed for. Biden would be more likely to calm trade relations with China and lift various sanctions on foreign countries. This would be beneficial to the stock market but more likely to reduce demand for gold.

OTHER CONTRIBUTING FACTORS

The FED has already committed to low interest rates, at least until 2023, in a bid to support economic growth and boost employment. This means the value of the US dollar is likely to weaken in the coming two years, no matter who is in charge. This will boost the price of gold but is bad for the economy. So, if Trump wins, the US dollar will weaken the least, it will weaken further in the case of a Biden win with a Republican senate, and it will weaken the most with a Democratic clean sweep.

Meanwhile, in any of these scenarios, there will still be plenty of external woes contributing to further volatility in the markets, possibly boosting the price of gold.

A CONTESTED ELECTION

There is also another situation which would not be pleasant for the country but would most probably send the price of gold soaring. And that’s a contested election. If there is no clear winner or Trump refuses to accept a Biden victory, chaos will ensue. The pandemic means mail voting is likely to be at record highs. This is difficult to manage in ordinary circumstances, but as Trump is very suspicious of the accuracy of mail voting, it’s likely to be a drawn out process. He has also twice now said he thinks the election is likely to end up in the Supreme Court. This scenario would drag out the process of confirming a new President at least into 2021.

Image taken from Joe Biden website

Image taken from Joe Biden website

All to Play For

The ultimate November 3 winner is still anyone’s guess? In the days following Trump’s hospital admission for Covid-19 treatment, a Reuters/Ipsos poll predicted Biden with a 10-point lead. The Wall Street Journal also carried out a poll after last week’s infamous and chaotic debate that puts Biden 14-points ahead. But with another month to go, there is still everything to play for and anything could happen between now and then.

Rising debt-to-GDP Ratio

The International Monetary Fund (IMF) has made the shocking prediction that US Government debt will be at 160% of GDP by 2030, even before any more stimulus is announced.

GDP can be thought of as the country’s income. If its GDP is higher than its debt, then it can afford to pay off its debt and continue running smoothly. If its GDP is very low, then it’s at risk of heading for a debt crisis. The US has a much higher debt-to-GDP ratio than it would like, thanks to all the quantitative easing put in place to combat Covid-19. Around two-thirds of the US public debt is owned by its banks, citizens and corporations, the rest being owned by foreign countries, mainly China and Japan.

When a country has a low GDP and high debt, the price of gold rises because people worry the country is headed for a debt crisis. This could occur if its creditors such as China or Japan demand higher interest on their outstanding loans to offset the risk of lending to the US. These gold buyers want to protect their standard of living and are buying gold because it’s seen as a safe haven investment in times of trouble.

Another alternative investment is Bitcoin, which, as seen in this chart, has been following a similar trajectory to the price of gold in the past year. Meaning both assets are likely to see a price increase if the financial markets are facing uncertainty.

The price of Bitcoin vs the price of gold – Source: Skew

The price of Bitcoin vs the price of gold – Source: Skew

Many people expect government stimulus to continue no matter who gets elected, which could again buoy the financial markets but create enough additional worry to boost the price of gold.

It’s plain to see no country is thriving now, and the US is in a particularly bad way. This uncertainty and worry put precious metals in a powerful position.

The price of gold see-saws on varying forces

So, in conclusion, what will happen to the price of gold if Biden wins? Biden’s anti-mining ethos could be bad for the price of gold, but his policies are likely to devalue the dollar which will enhance the gold price. This makes absolute prediction very difficult. There are also many other factors still at play, and if the past year is anything to go by, unexpected changes could be just around the corner. Massive stimulus packages will also play their part in increasing the worry of a debt crisis, driving up the price of gold. Or perhaps all the confusion and mixed messages will neither cause the price of gold to soar or plunge, but just continue ticking along at its current level.