Chart: S.Africa: WHITE BOYCOTT: Jewish owned Dischem’s share price drops by R1.9 billion ($109 million) after No Whites Letter

Dis-Chem loses R1.9 billion after no-whites letter

Daily Investor • 15 Nov 2022

Dis-Chem has lost R1.9 billion in value since a leaked letter from CEO Ivan Saltzman revealed a moratorium on employing or promoting white people.

On 19 September, Saltzman released a letter which prohibited the appointment and promotion of white people.

Solidarity CEO Dirk Hermann published the letter on Twitter on 13 October, causing a backlash against Dis-Chem and calls for a boycott against the pharmacy chain.

The company initially stuck to its ban on appointing or promoting white people, saying it regretted the wording and tone of the letter but not its intent.

“We stand by the unequivocal imperative to continue our transformation journey. Equality, diversity, and inclusivity are important throughout Dis-Chem,” it said.

However, after sales suffered and Solidarity threatened legal action, Dis-Chem backtracked on its moratorium.

The company said in a statement that there is “simply no ban on employing and promoting white individuals.”

Dis-Chem CEO Rui Morais confirmed that sales declined after Saltzman’s letter’s publication and the subsequent social media storm.

“We have seen our growth trend reverse from 17 October to 24 October when looking at daily sales numbers following the leaking of the memo,” he said.

Strong results with a short-lived share price rally

On 2 November, Dis-Chem released strong results for the half-year ended August 2022, with earnings per share (EPS) growing 45% and revenue growing 9% to R16.3 billion.

The company declared an interim dividend of R0.28 per share, and investors rewarded the retailer with a big share price increase on the day.

However, during Dis-Chem’s results presentation, it became clear that not all was well at the retailer.

The executives read the results of a script, and they did not take any questions after the session.

The presentation was uninspiring, and the executive team did not build trust that they were energised to grow the company.

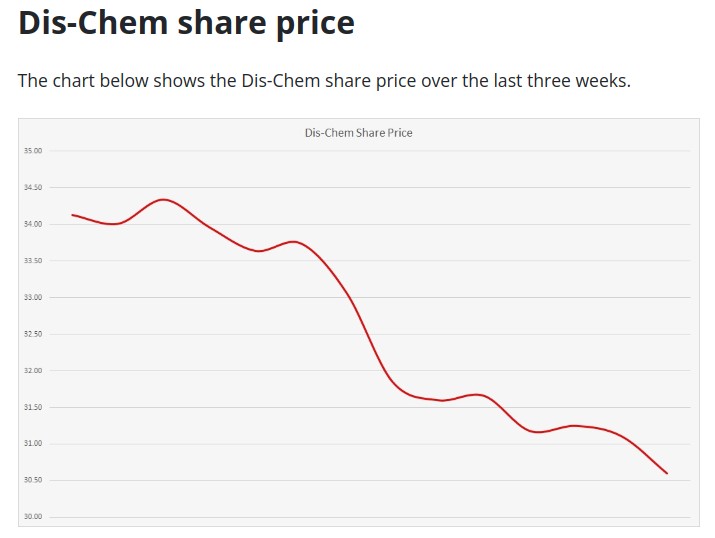

Following a short-lived rally on the strong results, the share price started declining as investors started to doubt Dis-Chem’s prospects.

The share price is now trading at lower levels than before the “no whites’ letter placing was published online.

Dis-Chem’s share price fell by almost 7% over the last month. Clicks’ share price, in comparison, increased 5% over the same period.

The share price decline translates into R1.87 billion of wealth destruction.

The exact impact of the letter is difficult to measure, and it may be significantly more or less than R1.87 billion.

What is certain is that the company will struggle to rid itself of the negative connotations associated with the letter.

Source: https://dailyinvestor.com/retail/5470/dis-chem-loses-r1-9-billion-after-no-whites-letter/?utm_source=everlytic&utm_medium=newsletter&utm_campaign=businesstech