SA Economy plummeting: Panic In Emerging Markets: South African Stocks On Track For Worst 3Q Since 2011

[This fascinating story from Zero Hedge matches up with a fascinating discussion I had with two investment analysts a week ago. This is more proof of what I've been told and think.

THE GLOBAL RECOVERY is nonsense. I was told that the world is still struggling with the almost total banking collapse of 2008. But the beautiful thing, which I liked was looking at South Africa's economy and it is in very bad shape. I had other additional information which makes the picture even worse. What I do note in these charts are Zero hedge's predictions of a big stock market crash coming to SA. That is awesome. I like that. I had not expected that.

I see that my own predictions and Zero hedges ones about the Rand falling to new lows – EXCELLENT.

We must STOP SAVING THE BLACK COMMUNISTS AND THE LIBERAL JEWISH SCUM. I would like to see whites pull away from those groups as much as possible in SA. We are KILLING OURSELVES BY WORKING WITH OUR ENEMIES.

I'm also delighted that “developing” (read: non-white) economies are floundering. This brings me to the part of the discussion I had with the analysts: IS GLOBALISM FALLING APART? And I won't say it is falling apart in a BIG WAY … YET … but it has serious problems and I think the Jewish Globalist theories are heading closer to going over the cliff. 2008 was as close as dammit … but maybe we're heading closer for even worse.

And it makes me happy. Globalism must DIE because that will kill Liberalism and it will allow whites to begin the process of re-taking the Western world. Jews are just lying to everyone and fooling everyone about the FAKE BENEFITS of Globalism.

Pull the Plug. Sink the ship. Better still, TORPEDO the bastard. And I like the failing economy in SA because that means the black/Jew game is sinking …. I like it all. SINK THE SHIP! Jan]

The world is on the cusp of an economic storm, and most global investors haven’t strapped on their rain boots nor deployed their umbrellas for what is coming in 2020. As we note in this piece, the most vulnerable fall first, all eyes on emerging markets for the next domino to drop.

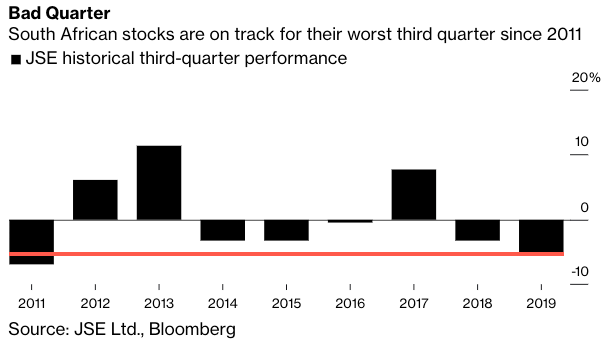

Bloomberg examines South African financial markets, where the Johannesburg Stock Exchange (JSE) is about to record the worst third quarter since 2011, an ominous sign that the global recovery this year is only a myth.

Bloomberg notes property and construction sectors of the JSE were the weakest performing sectors, along with technology, telecommunications, retailers, agriculture, education, and financial services.

South Africa barely avoided a recession in the second quarter, and economists are warning that unless the economy substantially expands in the quarter ahead, below-trend growth will return in 2020.

“South African needs a minimum of 2.5% growth consistently to cause the unemployment rate to fall and to stabilize public debt and at least structurally we’re some distance away from that milestone,” said Standard Bank chief economist Goolam Ballim.

South Africa faces ever-worsening economic and social problems heading into 2020; a slew of factors are driving the country towards collapse: increasing government debt, disintegrating infrastructure, collapsing education standards, widespread crime and violence, currency volatility, and investment outflows.

JSE, weighed down by domestic issues of an imploding country, is also dealing with a global economic downturn that is heavily weighing on emerging markets.

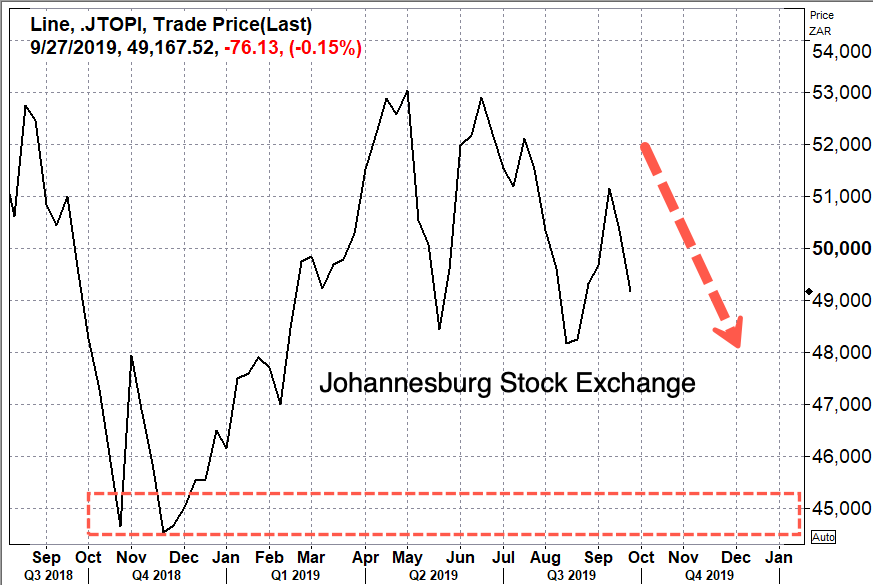

The South African rand is likely to break above the 15.2 level as the country’s socio-economic crisis continues to expand into 2020.

Investors are dashing into South African credit default swaps to hedge their credit portfolios.

And with the global economy faltering, it seems that South Africa, and most of emerging markets, will continue to deteriorate well into 2020.

Source: https://www.zerohedge.com/economics/panic-emerging-markets-south-african-stocks-track-worst-3q-2011